Our Portfolios

Energy Trading

In the arena of physical trades, the members of VM ENERGY LLC has deep extensive networks into the Oil and Gas producing nations of the Middle East, Africa, Latin America, Russia and Asia and will be selling to heavily into China, Korea and Japan.

The VM ENERGY LLC team trades worldwide in crude oil, petroleum products, natural gas and power. The company uses tankers and storage facilities in many locations in the world as regional supply hubs. In the financial energy markets VM ENERGY LLC trades futures, swaps and options across the energy spectrum and additionally in shipping, weather and energy-equity related derivatives.

VM ENERGY LLC shares its expert energy knowledge and insights with our clients and partners with whom we work with complete discretion to identify and execute energy risk mitigation strategies or to provide market-making services.

Energy Investments

Due to the deep links of the members of VM ENERGY LLC, we have been invited to assess and bring forward participation into both Renewable and Non-renewable Energy investment opportunities around the world. Projects are assessed according a strict criterion from our members. VM ENERGY LLC will decide to participate on an investment arranger or participant basis.

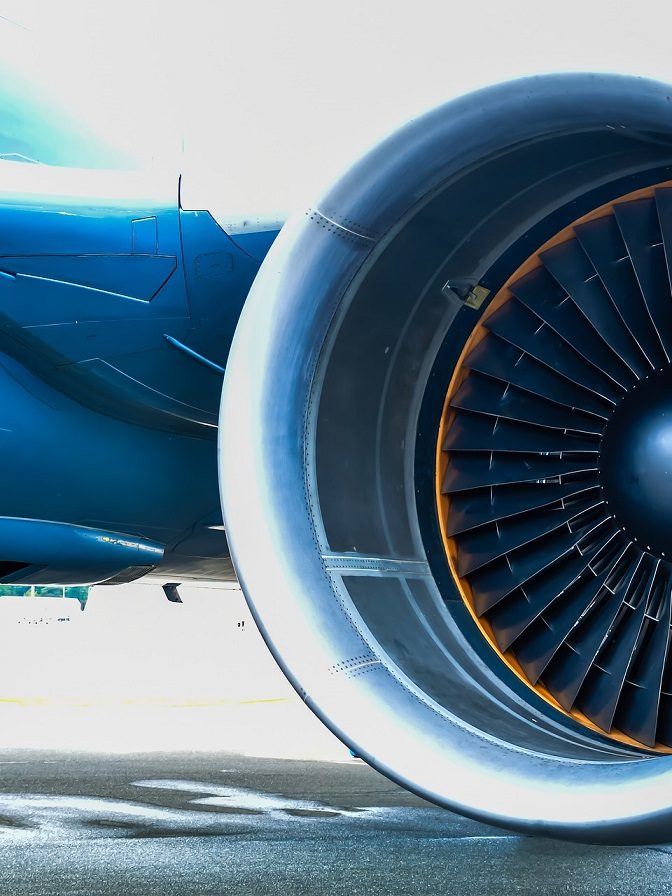

Aerospace

VM Aerosignia seeks to earn superior risk-adjusted returns by applying our principals’ deep operating and investment expertise, and the proven management experience of our Operating Advisors, all of whom are former CEOs or senior executives each with decades of aerospace and defense industry experience, to help our management partners build better businesses.

VM Aerosignia was founded in 2011 to continue a successful investment strategy focused on the aerospace and defense industry and complementary end markets. Our disciplined investment strategy is both proven and repeatable. First, we apply our deep industry operating and investment experiences, together with our broad industry relationships and those of our Operating Advisors, to proactively identify and develop investment theses for attractive segments of the global aerospace and defense industry.

.

Focus segments:

Aircraft Sourcing and Financing

Aerospace and High Technology Parts & Equipment Suppliers

Service Providers for Aviation, Aerospace Manufacturing and Aeronautical Players

MRO Business

Space and Defense Unique, Exclusive and Niche Opportunities

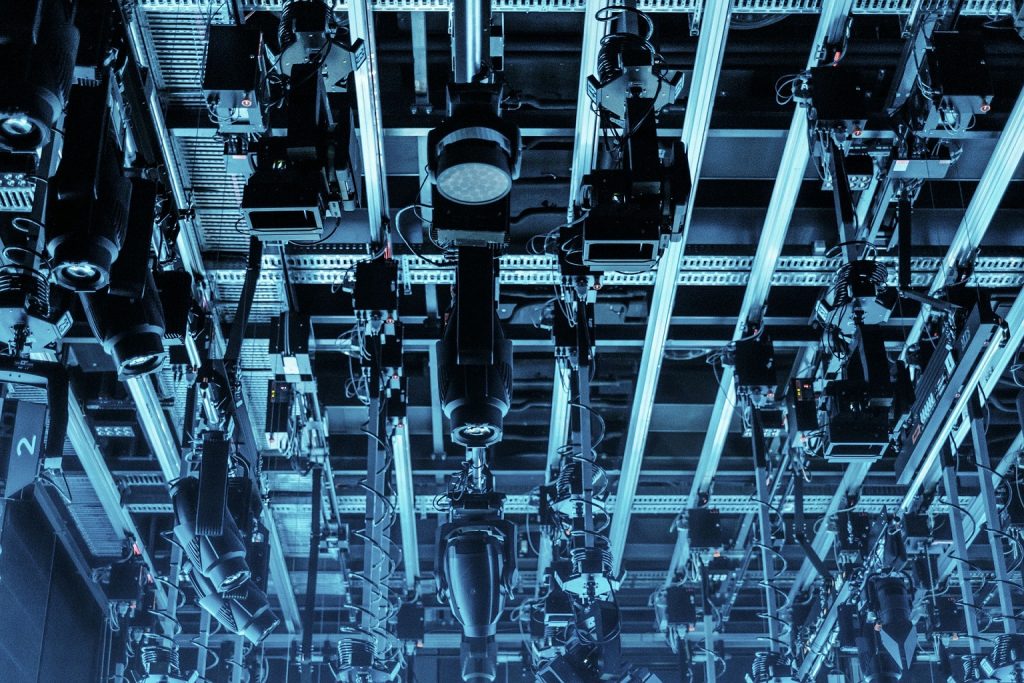

Technology

Our technology private equity and venture capital division VM Exilinx is based in Singapore.

Most of the technologies we invested in resulted in our ownership of intellectual properties, trademarks, exclusive next stage investment rounds and cross-network marketing opportunities and access.

Our Technology Investment Philosophy

Deep Technology

Deep technology has innovative scientific research at its core. We define it as technology that is expressed in engineering and applied commercially. We target capable founders and startups using deep tech to address global problems. Many of the biggest challenges today cannot be solved by a single startup or product alone, hence we always want to work alongside founders and partners who have a collaborative and global mindset.

To Build. To Invest.

Our Venture Building team focuses on early-stage deep tech startups in Singapore, where we leverage on our expertise and experience to help founders start and grow their businesses. Under Venture Building, we provide business building advice and work closely with the teams on areas such as fundraising, sales, strategy, branding and talent.

Scalable. Highly Skilled.

Our Venture Investing team focuses on scalable Singapore and overseas startups that address gaps within the Singapore deep tech landscape. Under Venture Investing, we focus on companies with proven technology and market traction, with the objective to speed up their internationalization through collaboration with our overseas portfolio companies and tap into our global network of institutional investors who invest in the same sectors as we do.

Agribusiness

VM AgriCore invests in companies that are transforming the safety, security and sustainability of global food. We invests in farmland acquisitions, soil treatment, crops farming technology and crops yield production technology.

Our investments focuses on the concept of increasing crop production and maximizing supply chains from farm to table. Our portfolios include companies with specialisation in fertilizer supplies and environmental friendly pest controls.

.

Deal Flow

VM AgriCore has framework agreements and special relationships with agriculture and food tech research institutions, thereby allowing early access to a wide range of promising technologies.

Reduce Execution Risk

Hands-on management & engagement of strategic industrial partners ensures effective and professional execution, along with highly efficient funds allocation between R&D, business development and commercialization.

Management Expertise

VM AgriCore’s management brings relevant background, professional relationships and know-how to drive its portfolio investments into successful products.

Mining

The Mining business is a very lucrative segment of the Natural Resources Industry. From Upstream, Downstream and Trading, the world’s industry evolved from the raw materials supplied by the mining activities.

The good news is that many people have made lots of money investing in mines. The bad news is that many have lost money, or had to wait many years for a fair return on invested capital. The basic reason is that mining is a risky business.